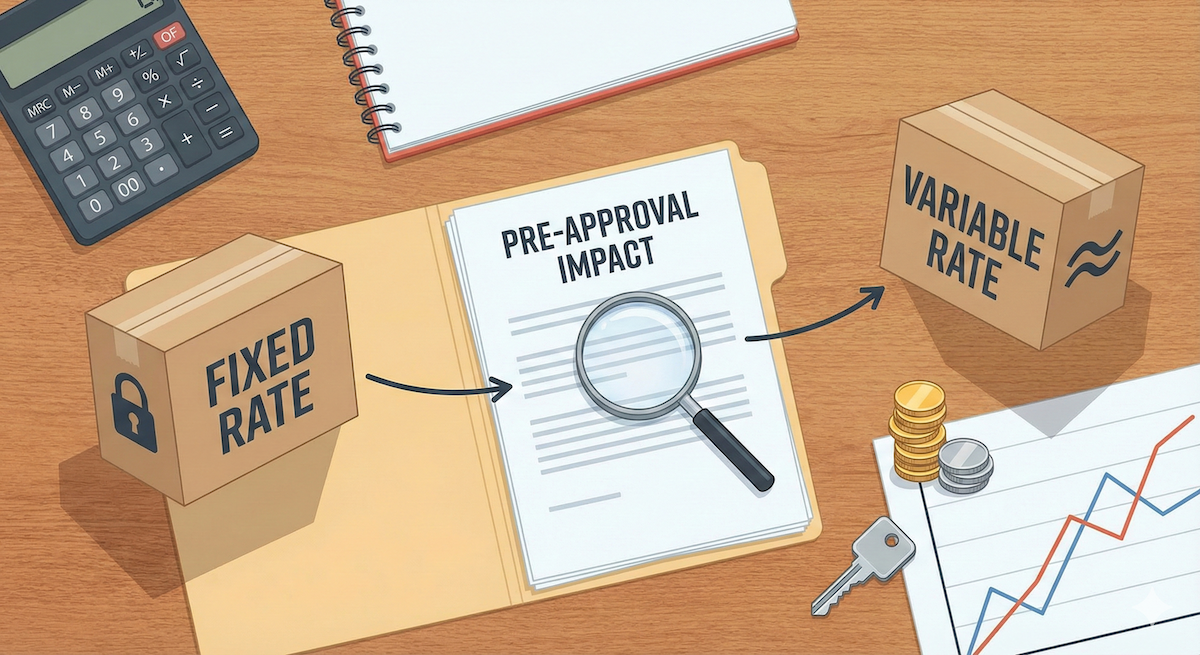

During pre-approval, you’ll have to choose between a fixed or variable mortgage rate. This decision affects how much you can borrow, your monthly payment, and even your approval odds. Knowing the differences helps you make a confident choice that fits your long-term goals.

Fixed mortgage rates

A fixed rate stays the same for your entire mortgage term, usually one to five years. Your payment amount never changes, which gives you predictability and peace of mind.

Pros:

- Steady payments that make budgeting easy

- Protection from future rate hikes

- Often preferred by first-time buyers

Cons:

- Usually higher than variable rates at the start

- Less flexibility to take advantage of falling rates

Variable mortgage rates

A variable rate can change whenever your lender’s prime rate moves. This means your payment or the amount going toward principal and interest may shift.

Pros:

- Lower starting rates

- Potential savings if rates drop

- Easier to switch or pay down faster with some lenders

Cons:

- Payments could rise if rates increase

- Harder to plan long-term budgets

How the rate type affects pre-approval

When lenders calculate your affordability, they use a stress test based on a qualifying rate that’s higher than your actual rate. For fixed mortgages, that’s usually the greater of 5.25% or your rate plus 2%. For variable mortgages, the same rule applies.

Even if variable rates are lower, the stress test can reduce your borrowing limit slightly compared to a fixed rate, especially if rates are volatile.

What to consider before choosing

- Your risk comfort level – Do you prefer predictable payments or potential savings?

- Market outlook – Are interest rates likely to rise or fall soon?

- Length of stay in the home – Fixed rates are ideal for stability, variable rates for flexibility.

- Prepayment options – Check if you can make extra payments or increase your monthly amount.

Fixed or variable for 2025?

In 2025, with rates expected to trend downward from the highs of recent years, many buyers are reconsidering variable rates again. However, the best choice still depends on your personal goals and comfort level with change.

An online mortgage broker like Homewise can show you both options side by side and help you compare the long-term costs. Apply for free now to find the rate that saves you the most money.

Fixed gives you stability, variable gives you flexibility.

Key takeaway

Both fixed and variable rates can work well, but understanding how they influence your pre-approval is key. Fixed gives you stability, variable gives you flexibility. The best choice depends on your financial comfort and market expectations.

FAQs

1. Can I change my rate type after pre-approval?

Yes, if you haven’t finalized the mortgage yet. Ask your advisor to update your file.

2. Does the rate type affect my credit check?

No. Your credit check is the same regardless of rate type.

3. Which rate type do most Canadians choose?

Historically, fixed rates are more common, but variable rates gain popularity when interest rates drop.

4. Is one better for first-time buyers?

Fixed rates are usually safer for new buyers who want predictable payments.