Your credit score plays a critical role in determining whether you qualify for a mortgage and what interest rates you’ll receive. For Canadian homebuyers, a higher credit score can mean lower monthly payments, better loan terms, and access to a wider range of lenders. If you’re planning to apply for a mortgage, improving your credit score can save you thousands of dollars over the life of your loan.

In this guide, we’ll break down the steps you can take to boost your credit score and position yourself for mortgage approval. Whether you’re a first-time buyer or looking to refinance, Homewise can help you secure the best mortgage rates and guide you through the process.

1. Why Does Your Credit Score Matter for a Mortgage?

Lenders use your credit score to assess how risky it is to lend you money. A higher score signals that you’re responsible with credit, which increases your chances of mortgage approval and better interest rates.

Here’s how credit scores impact mortgage rates in Canada:

- 760+ – Excellent: Access to the lowest rates

- 700 to 759 – Generally have access to the excellent rates as well

- 660 to 699 – often have access to the excellent rates as well, if other qualifications are strong

- 620 to 659 – may have access to the excellent rates as well, if other qualifications are stong

- Below 620 – Poor: May need to explore alternative (B Mortgage) or private lenders

2. How to Check Your Credit Score in Canada

Before you can improve your credit score, you need to know where you stand. In Canada, you can check your credit score for free through:

- Equifax Canada

- TransUnion Canada

- Borrowell (free credit monitoring)

- Credit Karma (free credit monitoring)

- ClearScore (free credit monitoring)

Review your report for errors—incorrect late payments or inaccurate account balances can drag down your score. If you spot mistakes, dispute them with the credit bureau.

💡 Need to get pre-approved for a mortgage? Start by checking your credit score and applying for pre-approval with Homewise in minutes.

3. How to Improve Your Credit Score Before Applying for a Mortgage

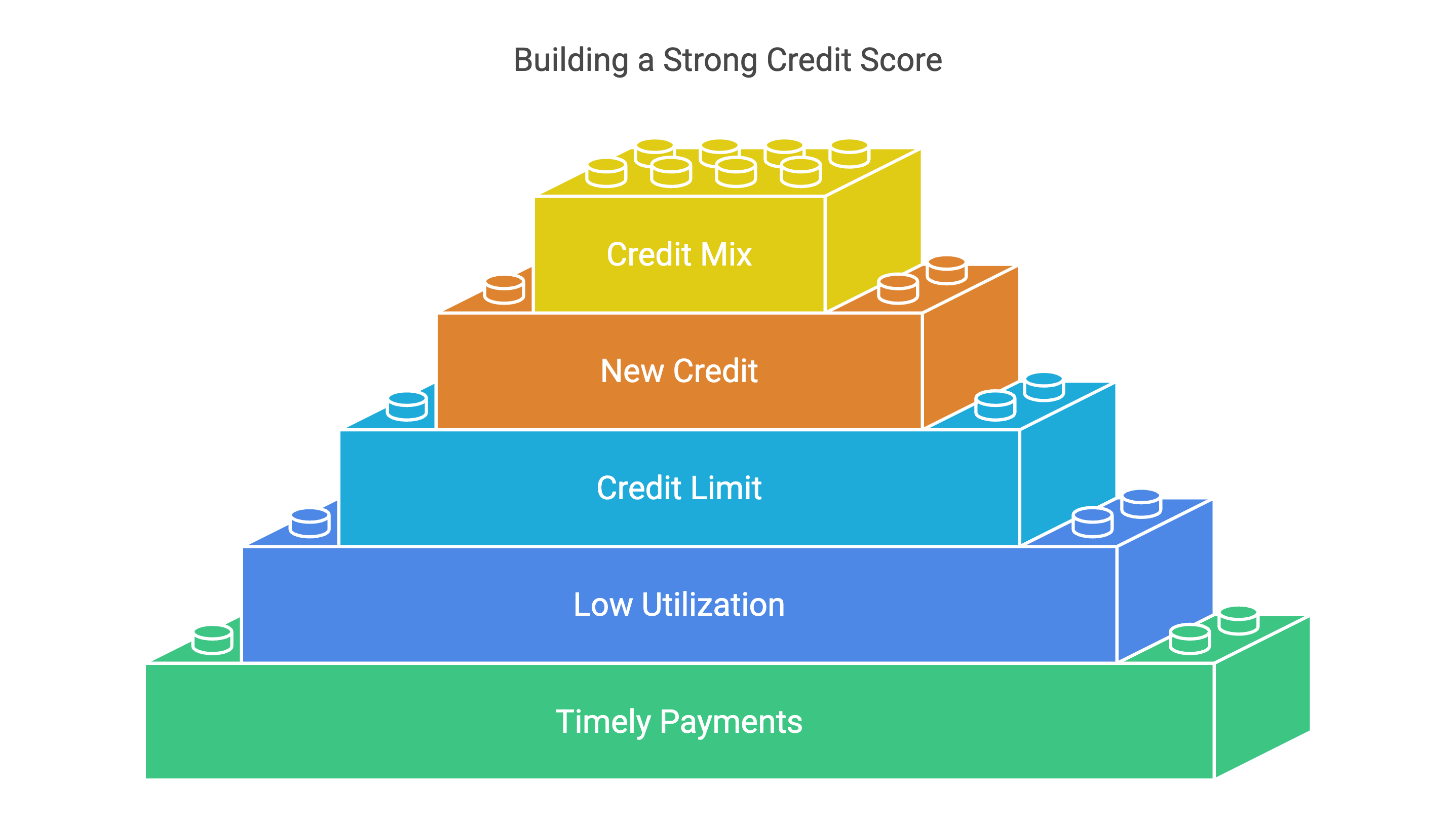

a) Pay Your Bills on Time (35% of Your Score)

Payment history is the most significant factor affecting your credit score. Even one missed payment can lower your score dramatically.

- Set up automatic payments for bills and credit cards.

- Prioritize overdue accounts to prevent further negative impacts.

Pro Tip: Late payments stay on your credit report for up to six years, but consistent on-time payments can gradually outweigh past mistakes.

b) Reduce Your Credit Utilization (30% of Your Score)

Credit utilization measures how much of your available credit you’re using. Lenders prefer to see credit utilization below 30%.

- If you have a credit limit of $10,000, aim to keep your balance under $3,000.

- Make multiple payments throughout the month to lower your utilization.

c) Increase Your Credit Limit

Another way to reduce utilization is by increasing your credit limit.

- Call your credit card provider and request a limit increase.

- Don’t spend more—keep your balance the same to lower the utilization ratio.

d) Avoid Applying for New Credit (10% of Your Score)

Every time you apply for new credit, a hard inquiry appears on your credit report. Too many inquiries in a short period can lower your score.

- Avoid opening new credit cards or loans at least six months before applying for a mortgage.

💡 Already applied for credit? Don’t worry—one or two inquiries won’t drastically impact your score, but multiple applications might.

e) Diversify Your Credit Mix (10% of Your Score)

Lenders like to see a mix of different types of credit, such as:

- Credit cards

- Car loans

- Lines of credit

- Student loans

However, only borrow what you need. Managing different types of credit responsibly helps build a stronger score.

4. How Long Does It Take to Improve Your Credit Score?

Building or repairing credit takes time. On average, you can expect to see improvements within three to six months if you consistently pay down debt and make on-time payments.

- Minor improvements: 30 to 60 days

- Moderate improvements: 3 to 6 months

- Significant improvements: 12 to 18 months

5. Don’t Let a Low Score Stop You From Buying

If your credit score isn’t perfect, don’t panic. There are still options:

- B lenders and alternative lenders offer mortgages to those with fair or poor credit, often at slightly higher rates.

- Private lenders may provide short-term mortgage solutions until your credit improves.

Homewise works with lenders across the spectrum to help you find the right mortgage—regardless of your credit score. Start by applying for a mortgage pre-approval today.

6. The Best Time to Apply for a Mortgage

The best time to apply for a mortgage is when:

- Your credit utilization is below 30%.

- Your bills have been paid consistently for at least six months.

- You haven’t applied for new credit in the last three to six months.

Timing is everything. If you’re not quite ready, focus on improving your score, then apply when you’re in the best position to secure lower rates.

7. How Homewise Can Help

At Homewise, we make the mortgage process simple. Whether you’re improving your credit or ready to apply, we work with over 30 lenders to help you find the best rates and terms. Our platform makes it easy to get pre-approved in minutes, and our advisors guide you every step of the way.

🏠 Ready to start? Apply for a mortgage with Homewise today and let us help you achieve your homeownership goals.

Conclusion

Improving your credit score before applying for a mortgage is one of the smartest financial moves you can make. By focusing on reducing debt, paying bills on time, and managing credit wisely, you’ll position yourself for better rates and long-term savings.

Whether you’re just starting your journey or need guidance along the way, Homewise is here to help. Apply for a mortgage today and take the first step toward homeownership.