One of the most important decisions you have to make when it comes to selecting the right mortgage is your amortization period. In this article, we'll break down what the amortization period means for your mortgage and help you figure out which length suits you best.

What is an amortization period?

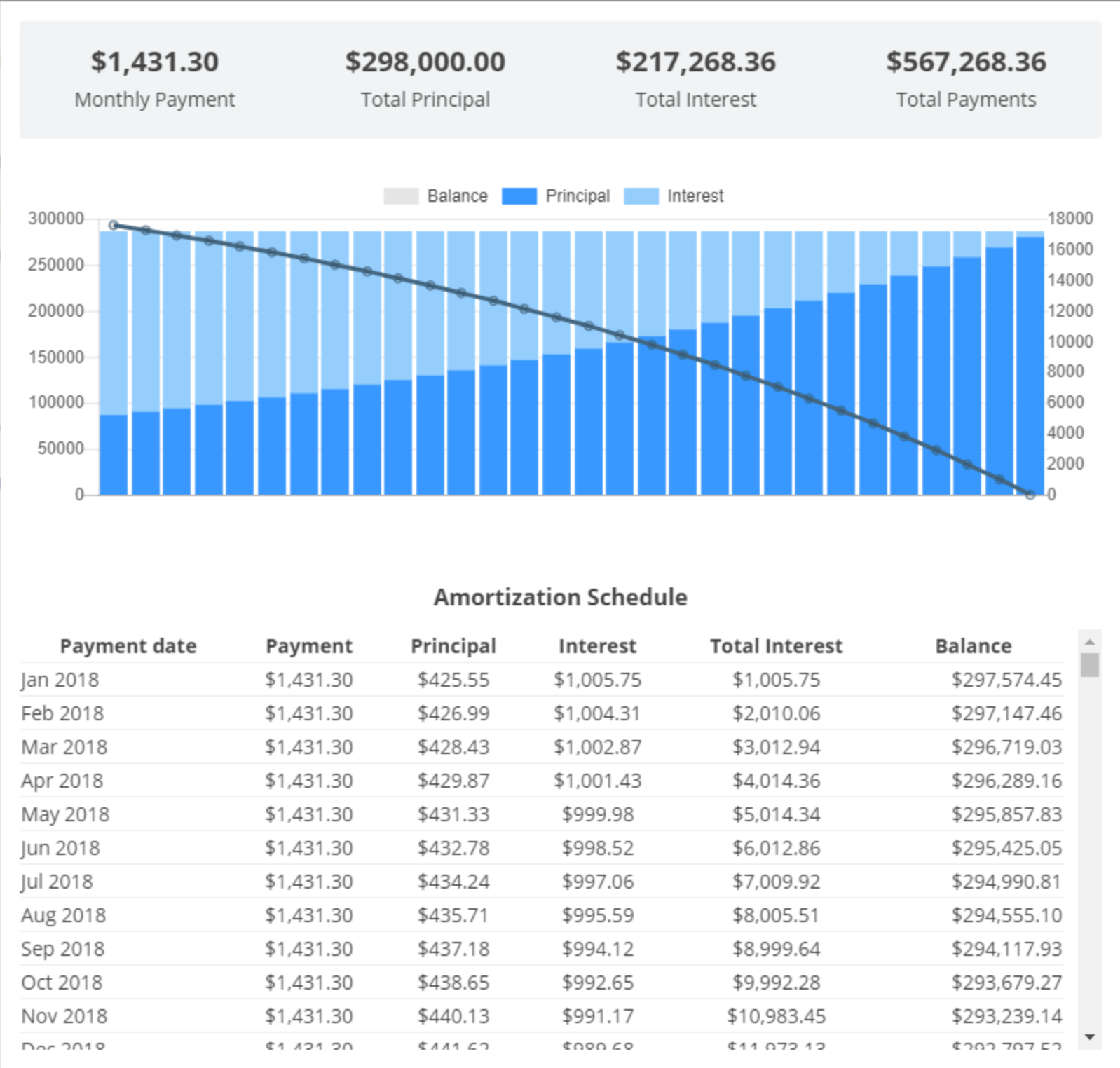

The amortization period for a mortgage is the number of years you have to pay back your mortgage loan. The length of your amortization period is a crucial choice as it directly impacts the amount of interest you'll pay throughout your mortgage's lifespan. While the standard amortization period has traditionally been 25 years, shorter or longer options are also available.

Pros and cons of a shorter amortization period

The main benefit of choosing a shorter amortization period is that you can significantly reduce the amount of interest you'll pay over the course of your mortgage – which translates into substantial savings. A shorter amortization period also allows you to become mortgage-free sooner, providing you with financial freedom and peace of mind in the long run. By paying off your mortgage quicker, you can build home equity faster, which you can leverage to invest in a second property or secure low interest financing for various purposes such as home renovations, funding education or other personal reasons.

While these are compelling benefits, it's important to keep in mind that since you'll be making fewer mortgage payments in a shorter time frame, your regular payments will be higher. This may not be ideal if your income is irregular or if you're a first-time homebuyer with a large mortgage and limited cash flow. However, if you can afford higher payments and want to avoid long-term debt or high interest payments, a shorter amortization period may be a great option for you.

Pros and cons of a longer amortization period

A longer amortization period allows you to get your desired home sooner and reduces your monthly payment amount. By spreading your payments over a longer time period, you can qualify for a higher mortgage amount and enter the housing market earlier. The most important consideration with a longer amortization period is that it means paying more interest over the life of the mortgage. Depending on your finances, it’s key that you consider the trade-off between affordability and overall interest costs when making your decision.

Remember that you have flexibility

If your financial situation changes, there are options available to modify your mortgage and save on interest costs. Accelerated payment options, extra payments, and annual lump sum prepayments can effectively shorten your mortgage term and reduce interest paid. Some lenders may offer early payment options – although it’s important to note whether you have prepayment privileges on your mortgage contract and if penalty fees apply. Other alternatives include paying off your mortgage in full at the end of a term instead of renewing, or refinancing and adjusting your amortization period to one that better suits your current needs.

In today’s market, buyers should really take the time to work with a dedicated mortgage advisor who can walk them through the process of securing a mortgage that checks all of their boxes – especially when it comes to their amortization period. At Homewise, our team is here to help you navigate the complexities with ease so that you can feel confident in your decision. Connect with us today by applying online in just five minutes.